Vietnam

September 17, 2025

Selling Pressure Mounts as VN-Index Stumbles Below the 1,700-Point Threshold

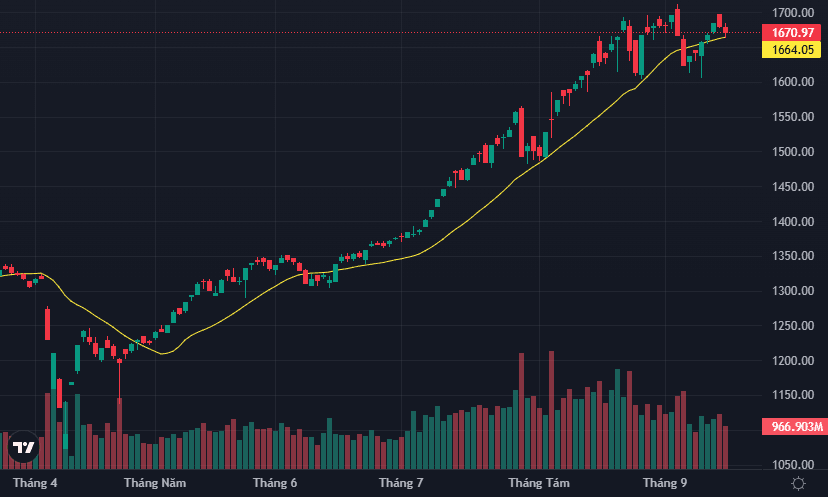

On September 17, 2025, the Vietnamese stock market closed a volatile trading day. The VN-Index ended at 1,670.97 points, down 9.93 points or -0.59%. Earlier in the morning session, the index nearly touched 1,697 points, fueling expectations of breaking through the psychological threshold of 1,700. However, heavy selling pressure in the afternoon erased early gains, causing the benchmark to once again retreat before reaching this crucial resistance level.

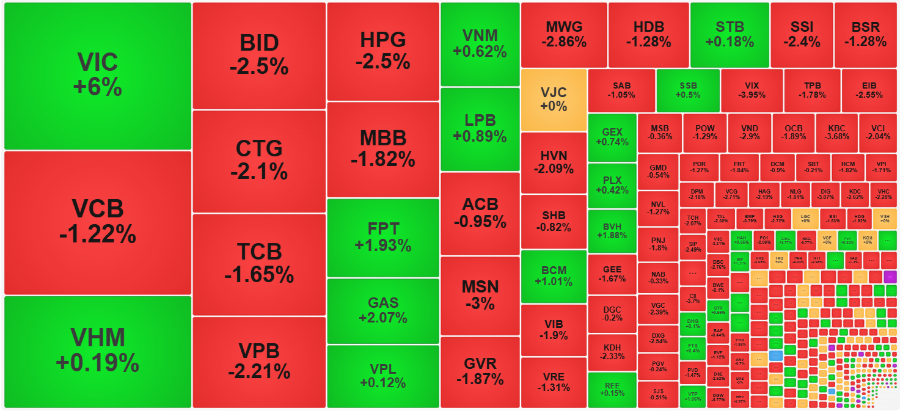

The VN30-Index, which tracks the 30 largest-cap stocks, also slipped slightly, reflecting the strong divergence among blue-chip stocks. Market liquidity surged in the afternoon session, but the buying momentum was insufficient to offset broad-based profit-taking.

Key Market Developments

Blue-chip support: VIC stood out as the brightest star of the day, surging strongly and even hitting an all-time high of around VND 143,000 per share. Thanks to its large market cap, VIC helped soften the market’s overall decline. Other heavyweights such as VNM and FPT saw morning gains fade as the session progressed.

Widespread selling pressure: Many other large-cap stocks came under strong selling, particularly within the VN30 basket. The lack of consensus among market leaders prevented the VN-Index from sustaining upward momentum.

Foreign investors turned sellers: While foreign investors were net buyers in the morning, they switched to strong net selling in the afternoon. Key stocks such as MSN, VPB, VHM, SSI, and STB faced notable outflows, which weighed further on investor sentiment.

Liquidity spiked: Total trading value on HOSE jumped by more than 50% in the afternoon compared to the morning session. This clearly reflected increased profit-taking as the VN-Index approached the 1,700-point mark.

The 1,700-point psychological barrier

Over the past weeks, investors had been expecting the VN-Index to break above 1,700 points, supported by steady inflows and key large-cap stocks. However, the 1,700 level remains a strong psychological barrier, prompting many investors to take profits when the index nears this zone. Consequently, the market has repeatedly “run out of breath” just shy of this milestone.

Liquidity and capital flow

Although trading liquidity improved in the afternoon, it was primarily driven by selling rather than strong, broad-based buying. This indicates that investor confidence remains cautious, especially as the upward momentum was concentrated in only a few large-cap names.

Foreign net selling

Persistent net selling by foreign investors continues to be a headwind. With global markets on edge ahead of the U.S. Federal Reserve’s key monetary policy decision, international investors are adopting a risk-averse stance, dampening domestic sentiment.

Technical Perspective

From a technical standpoint, the VN-Index remains above the 20-day moving average (MA20) – a key short-term support. If this level holds, the index may attempt another rally toward 1,700 points. Conversely, a breakdown below MA20 could trigger a retreat to the 1,650–1,630 range.

Short-Term Outlook

Brokerage firms generally agree that the VN-Index is likely to consolidate within the 1,650–1,700-point range in the short term.

Bullish scenario: If inflows return to leading sectors such as banking, real estate, and consumer goods, and foreign selling eases, the index could successfully challenge the 1,700-point threshold.

Bearish scenario: On the other hand, if selling pressure broadens and profit-taking accelerates, the VN-Index may correct further, testing lower support levels.

Investment Implications

Exercise caution near resistance levels: Avoid chasing prices at highs, especially while the market remains volatile near 1,700 points.

Focus on fundamentals: Prioritize companies with solid earnings growth and macroeconomic tailwinds rather than short-term speculative plays.

Track foreign flows: Net buying or selling by foreign investors will remain a critical driver of market psychology.

Manage risks proactively: Apply stop-loss levels, reduce margin exposure, and be ready to rebalance portfolios if market signals turn negative.

The September 17 session highlighted the fragile momentum of the VN-Index as it once again faltered before the 1,700-point mark. Despite support from select blue chips, heavy selling pressure and strong foreign outflows weighed down the index. In the near term, the VN-Index is expected to continue moving sideways within a narrow band, with risk management and selective stock-picking remaining key strategies for investors awaiting a clearer breakout signal.